Mena startups raised $95 million in July 2023

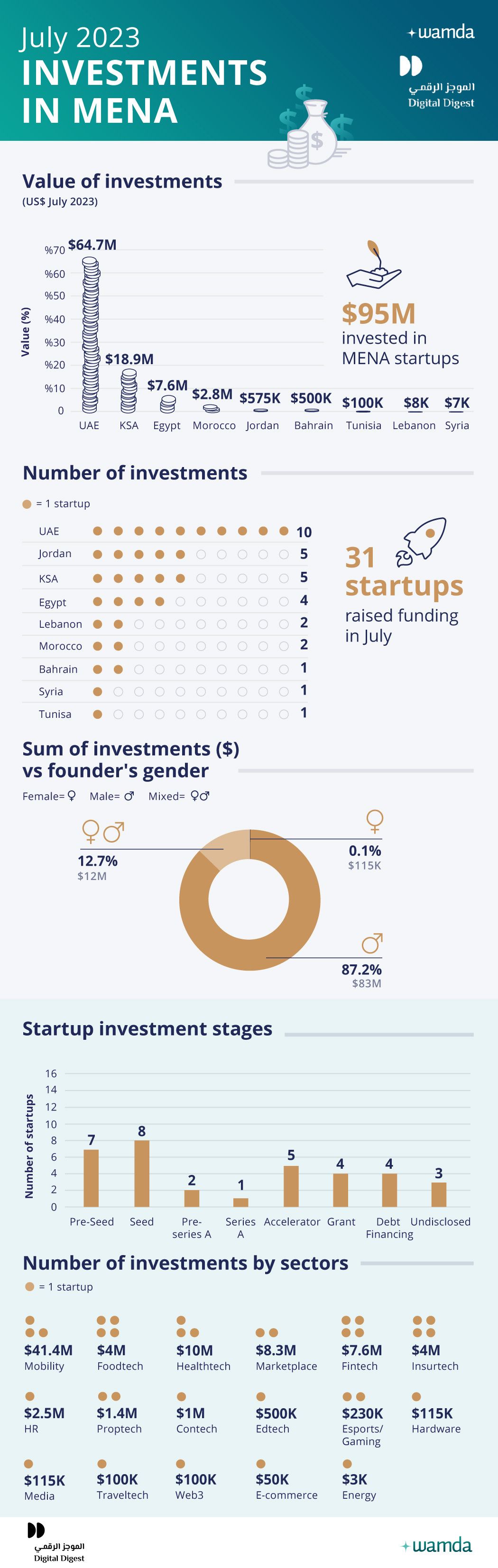

Startups in the Middle East and North Africa region (Mena) have raised $95 million across 31 deals in July 2023, a slight dip from the $105 million recorded in the same month last year.

Month-on-month, the dollar figure showed a 167 per cent increase from June’s $35.6 million, while the deal volume fell by 31 per cent. However, the picture shifts slightly when we take out One Moto’s $40 million lease financing round, reducing the equity investment of July to $55 million, a 55 per cent increase month-on-month.

Further, without One Moto’s round, the total amount raised by UAE-based startups was just $14 million across nine deals, less than the $18 million raised by five Saudi Arabia-based startups. Foodtech Kaso, based in Riyadh, raised the largest round with $10.5 million Seed.

Egypt and Morocco secured the third and fourth spots, attracting $7 million and $2 million, respectively.

With 15 deals, Seed and pre-Seed stage startups dominated the deal volume. Funding for late and growth-stage startups has contracted, a large contributor to the slowdown in venture capital activity in July.

As the largest fundraiser of the month, One Moto’s round helped the mobility sector become the top-funded sector of July. Foodtech, however, is believed to be the largest beneficiary of capital raised in July, with $17 million raised across five deals, fueled by the growing adoption of enterprise SaaS solutions in the F&B sector. Fintech attracted four deals; however, it remained off the list of the top-funded sectors in July.

Gender-wise, female-founded startups continue to remain heavily underfunded, with most capital raised through accelerators and incubators. In July, only one deal went to a female-led startup, Jordianin proptech Nomad, a recent graduate of the Flat6labs Amman accelerator programme.

Mixed-gender founding teams fared better, attracting $12 million across six deals. All-male-led startups grabbed 87 per cent of the total funds, to the tune of $84 million. The most active foreign investors were based in the US, participating in 10 deals. Regionally, investors based in Egypt and the UAE both participated in eight deals, while Saudi Arabia-based investors took part in seven deals.

Aside from funding, last month saw a couple of acquisition deals including Jordan-born and Saudi-based HyperPay’s acquisition of Sanad Cash and the Abu Dhabi-owned EDGE Group’s acquisition of OrxyLabs. Meanwhile, Germany’s Delivery Hero acquired the remaining shares of Saudi Arabia’s food delivery platform, HungerStation for $297 million.

Other key highlights include the launch of a $54 million footech-focused fund by Agthia Group as well as a new accelerator programme geared towards Egypt-based accelerator and incubator managers by 500 Global.

Last month, eight startups did not disclose the exact amount they raised. They include Dharma, Kaco, Oumla, and Menthum, and Tenderd, we assigned a conservative amount of $100,000 to the first four and $1 million to Tenderd.

These monthly reports are a collaboration between Wamda and Digital Digest.