Anghami: Success built on localisation

When Eddy Maroun was skiing in a Lebanese mountain resort back in 2011, accessing music was a cumbersome affair. Music players like the iPod were already rife, but they required users to first download songs and install them onto the music player or convert them from CD to MP3 files. That was the main option available to those willing to pay for their music and avoid piracy, which was, and still remains commonplace in the Middle East and North Africa (Mena). In the West, music streaming platforms had started to emerge and it was on this holiday that Maroun considered launching something similar in the Middle East.

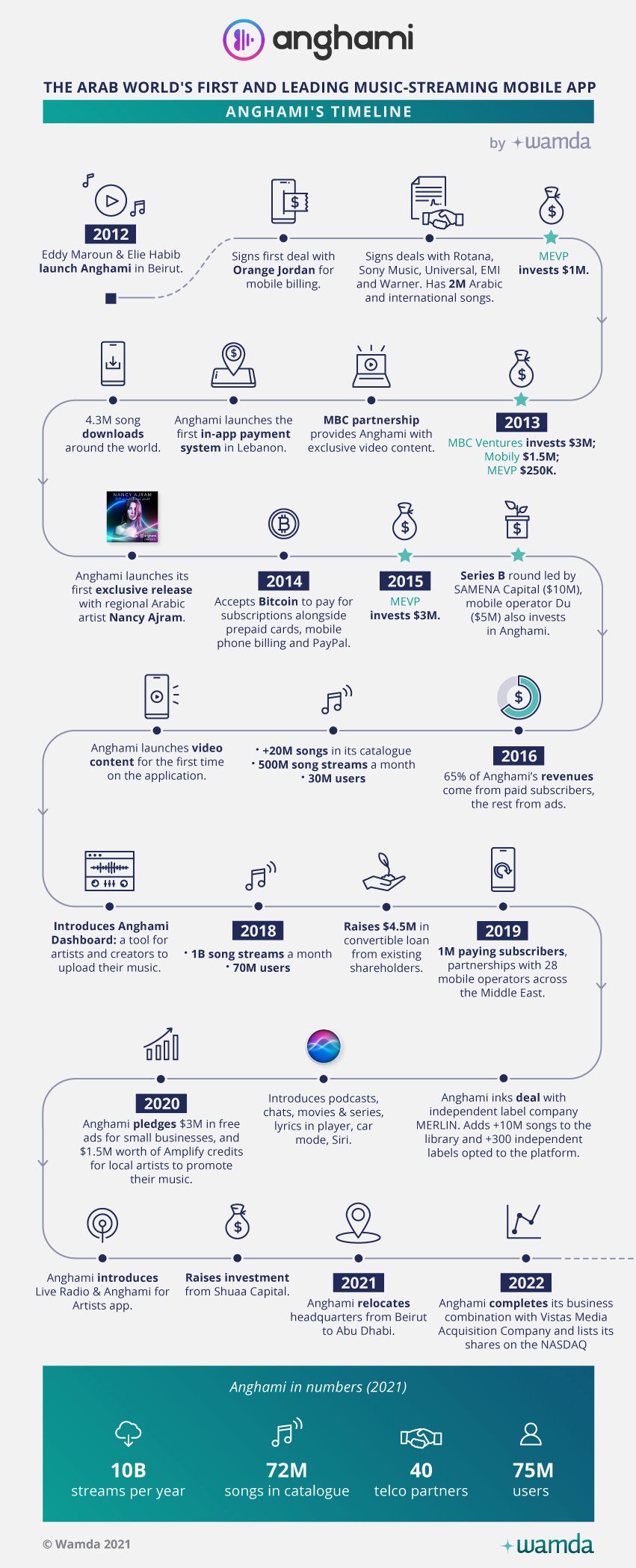

He shared his vision for a Mena-focused music streaming app with Elie Habib and the pair co-founded Anghami in 2012, which has now become the first regional tech startup to list on the NASDAQ in New York.

The listing, via a merger with special purpose acquisition company (SPAC) Vistas Media Acquisition Company (VMAC) valued Anghami at $220 million at the time of the announcement. After it began trading on the NASDAQ on 4 February 2022, Anghami saw its shares skyrocket 80 per cent raising its market capitalisation to over $500 million, before settling to $250 million at the time of publishing.

With 75 million registered users and over a billion song streams a month, Anghami is Mena’s biggest music streaming platform and a success story for the region’s startup ecosystem.

But Habib and Maroun’s journey was not without its challenges. While the pair quickly raised $1 million in 2012 from Lebanon-based venture capital (VC) firm Middle East Venture Partners (MEVP) and managed to sign partnerships with Rotana, Sony Music, Universal, EMI and Warner, providing them access to two million Arabic and international songs, the market’s appetite for music streaming was small.

Initial challenges

When it initially launched, the internet penetration across the Middle East and North Africa was no higher than 25 per cent in more than half of the countries in the region according to the World Bank, while in the GCC it exceeded 50 per cent. Mobile penetration however was on the rise and the availability of cheaper smartphones enabled vast swathes of the population to experience the internet first via mobile, which is why Anghami launched initially as a mobile app.

Back then the most common handsets in the Middle East were Nokia phones, and many countries were either on 2G or 3G mobile frequencies, far slower than the 4G and 5G speeds we have today.

“When we started it was really on devices that were not designed to stream, they didn’t have the capabilities that you find on Androids or iPhone today. What helped was the speed of mobile internet and the whole infrastructure and ecosystem that helped grow adoption and consumption. The hardware part is very essential, another part is connectivity and that became more and more available,” says Maroun.

Figuring out payments

It was with the rise of smartphone penetration and 4G that streaming really picked up. But even with the development of handsets and connectivity, there was still one major issue – payments.

Convincing people to pay for music was one of Anghami’s biggest challenges. The freemium model, providing free access to music, punctuated by the occasional advert was working, but converting users to subscribers took greater effort.

“It wasn’t easy to convince people to pay for music, they’d never paid for music. They never had the culture of paying for music. That was part of the education…you needed to give them payment mechanisms,” says Maroun.

According to the World Bank just 14 per cent of people in the Middle East and North Africa have a bank account, the highest unbanked rate in the world. Credit card penetration remains low across Mena and the digital payments space when Anghami launched was still in its infancy and so the most viable solution to get users to pay for a subscription was through the telecoms operators through direct mobile billing. The first to sign up was Jordan’s Orange and soon, others began to partner up with Anghami, encouraged by a new revenue stream and service they could offer their users.

“The telcos have been instrumental in making it easy for users to subscribe in a convenient way. They were seeing the traction of the platform and they were happy to see how we could monetise this transaction. [Telcos] don’t just want to be pipes, most of them were trying to give incentives to the users so that it’s not just a payment method. Sometimes [the Anghami subscription] comes with free data package, and payment flexibilities like paying daily or monthly – all of this helped us to scale up and grow our subscriptions base,” says Maroun.

Understanding these nuances of the Mena market, from the mobile infrastructure to the lack of credit card penetration helped Anghami to not only scale, but maintain its market leadership when global players started entering the region.

Today, Anghami has 40 direct telco partnerships, and direct mobile billing remains the dominant payment method for its users. Saudi Arabia’s Mobily even became an investor in 2013, putting in $1.5 million alongside Dubai-based du in 2014 which invested $5 million.

“This is part of the localisation you always have to think about, I don’t think a global company will go to each telco and go through each of their billing cycle,” he says. “This is a very strong edge we have as a local player to remain competitive and we have a very solid differentiator compared to the global competition.”

In 2018 both Spotify and Deezer entered the region, two players that enjoy strong presence around the world. The growing competition helped with educating the market says Maroun and as a result, Anghami’s own user base rose.

“The biggest competitor for us has always been piracy,” he says. “When Spotify and Deezer came to the region we had growth, the past three years we grew by 80 per cent. Having competition might sound like they will eat your market share, but it educates the market more, there is more awareness around streaming, it grows the whole pie and ecosystem, and it puts you on your toes, you want to innovate more and you want to push yourself more.”

Maroun refuses to reveal whether either Spotify, Deezer or other platforms made an acquisition offer, but says “if you want to be dominant in the Middle East, Anghami is the obvious target”.

Pandemic

By 2016, Anghami had amassed 30 million users of which 65 per cent were paying subscribers and had built up a catalogue of 20 million songs and raised $23.7 million from investors which included $3 million from MBC Ventures who also provided Anghami with exclusive video content. Anghami’s platform continued to mature, adding new features and services along the way including podcasts, movies and TV series streaming by 2019 when it reached one million paying subscribers.

The company seemed to be going from strength to strength, until the pandemic hit.

“The pandemic was one of the biggest challenges, we were in a tunnel without any lights, no visibility on what was going to come or how we were going to go past this. It came at a stage when we were fundraising and we were looking for funds to grow. It was really hard, the learnings out of these times are very important,” says Maroun.

At the beginning of the pandemic, consumption dropped by about 10 per cent on the platform, people were consuming more news than listening to music, artists were not releasing new content, but eventually habits went back to “normal”.

During this time, the team pushed themselves to be more “disciplined and nimble” according to Maroun and worked hard to launch new features including virtual concerts and live radio.

“We pushed ourselves more and more to become efficient financially, we closed the year at almost being topline positive,” he says.

The company eventually did secure funding, this time from Shuaa Capital in December and the Abu Dhabi Investment Office (ADIO) which prompted Anghami to relocate its headquarters from Beirut to Hub71 in Abu Dhabi, a move that Maroun says is “more suitable” for Anghami’s next phase of growth.

“You have a much bigger economy [in the UAE], you’re closer to your core markets, you have easier access to the world and talent, you have more access to capital, this is very important and you have a serious and tremendous support by government authorities who are conscious of growing home-grown and local tech companies,” he says.

Future growth

While Habib and Maroun had several exit offers, they refused. As a “pan-Arab media tech company”, the pair thought it more important for the region to go public and develop the local ecosystem.

“We were exploring a lot of funding options, mostly on private placement level. We started to see the emergence of SPACs in the US, we had been approached by Vistas and we clicked, we thought their size and our stage of the company are a perfect match, being public in a liquid market made perfect sense for us,” says Maroun.

Going public on NASDAQ will enable Anghami to be “more local” and “more independent” according to Maroun.

"When you’re not reliant on VC funds or you’re not acquired by another company, you maintain some sort of independence on how you want to function. This has been one of the core pillars in our decision to go public. We didn’t want to settle for another company and somehow kill the Anghami brand and the experience we’ve been building for this particular audience,” he says.

We believe Anghami can always be this Arab platform that provides more customisation and works closer with the Arab and local and ecosystem. We have the funding to grow and do better without being under a bigger company.”

Now that it has gone public, this is when the “real work starts”, says Maroun, which will entail growing the team and establishing a research and development (R&D) centre in Abu Dhabi, to innovate and “be more adaptive and relevant to the region”.

Anghami's AI and machine learning algorithms currently process over 56 million data points from its user base every day. Over nine years of user data is enabling the company to predict user behaviour and trends to better focus its investments and improve monetisation.

“We always innovate in our space to be more relevant and respond more the needs of our market and ecosystem, we always believed the region’s Arabic content is very under-penetrated,” says Maroun.

The platform now has more than 72 million songs, of which only 1 per cent is Arabic, whereas consumption of Arabic songs accounts for half.

“There is a gap in demand and supply and there is an opportunity for Anghami to play a role in filling this gap,” he says. In late 2021, Anghami launched record-label Vibe Music Arabia in partnership with Sony Music Middle East dedicated to supporting the independent Arab artists across the GCC and Levant. The label will help provide a way for Arab artists to reach their audience and “monetise through streaming, brand partnerships” while giving them “a platform or stage to develop their identity as artists from a popularity point of view and revenue points of view”.

The company is also setting its sights on future growth in Saudi Arabia and Egypt, “there’s huge potential and a lot of untapped potential in the Mena region,” says Maroun.

This article was originally published in March 2021