Mena startups raised $156 million in October 2023

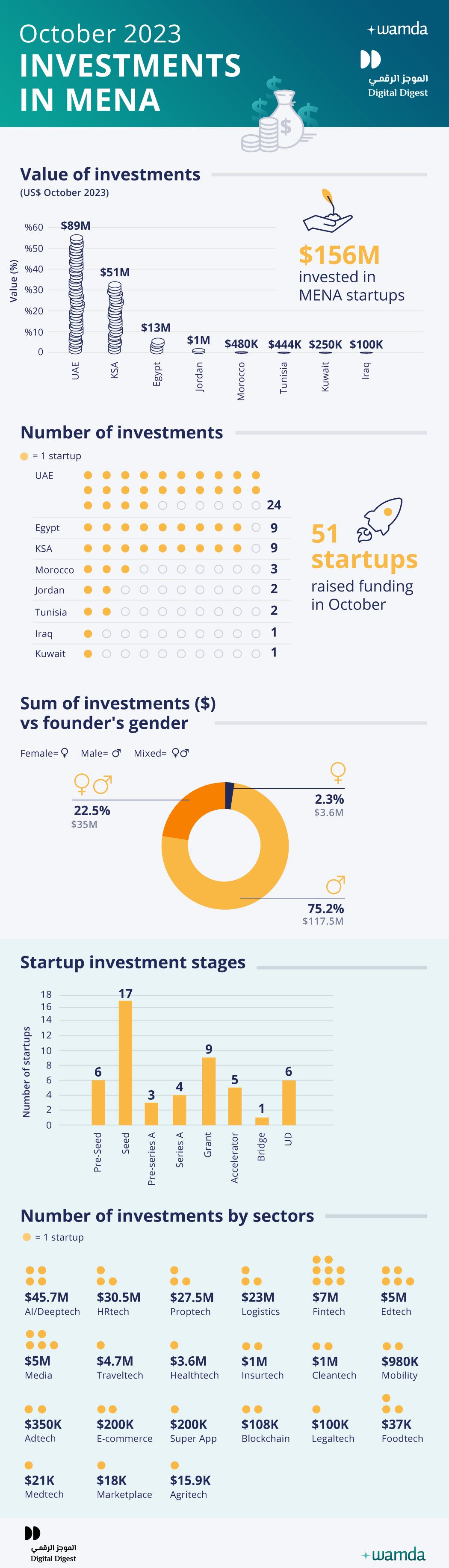

Funding in October 2023 saw a turnaround after exhibiting a downward trend for the past four months. Startups in the Middle East and North Africa region (Mena) raised $156 million in October, way ahead of September’s $63 million figure, representing a 333 percent increase month-on-month but a 76 per cent drop year-on-year.

This also takes the total amount raised over the period of January–October to $1.9 billion, a decline of 36.6 per cent from the $3 billion recorded in the corresponding period last year.

Despite the drop-off in deal value month-on-month, the deal count saw a surge from 36 in September to 51, bolstered by the deals completed through accelerators.

Overall, the highest capital injection was concentrated in the UAE, Saudi Arabia, and Egypt, respectively.

UAE startups grabbed the most capital and rounds, with $90 million raised across 24 deals. The top fundraiser was XPANCEO, a UAE-based deeptech startup that offers the next generation of computing via an invisible and weightless smart contact lense. XPANCEO raised a $40 million Seed round led by Hong Kong-based Opportunity Ventures.

With $51 million, Saudi Arabia-based startups raised the second-highest prortion of the amount raised last month, primarily thanks to HR-tech Jisr’s $30 million Series A round led by Merak Capital. Egyptian startups raised $13 million, with deeptech Pearl Semiconductor leading the fundraise. Both countries attracted nine deals each.

In terms of value, about 93 per cent of the capital was driven by Seed and pre-Series A activity. Seed-stage startups raised 17 rounds worth $72 million, while Series A funding amounted to $63 million spread over four rounds. This indicates a higher investor appetite for betting on startups that can offer risk-adjusted returns in the long run.

That said, there was a complete absence of financing for growth or later-stage startups in October.

In terms of sectors, deeptech dominated the venture capital inflows, with $45 million raised across four deals, the largest of which was that of XPANCEO.

Jisr’s round alone pushed HR-tech to the second rank.

Proptech and logistics emerged third and fourth, securing $23 million and $20 million, respectively, with Nomad Homes taking the lead in the former category and Neo Mobility in the latter.

Other sectors that attracted substantial investor interest include insurtech, media, traveltech and edtech. Fintech saw funding drop to $7 million, down 56 per cent month-on-month.

In a rather positive development, last month saw a rise in the number of deals that attracted foreign investment. Of the 51 deals, 20 had at least one foreign investor.

Regional investors backed 31 deals, with UAE-based investors being the most active with 14 deals, followed by their Saudi Arabian counterparts with 11.

Gender-wise, mixed-gender founding teams fared better last month, securing 22 per cent of the funding. Male founders captured 75 per cent of the capital, while female-led startups took the remaining three per cent.

In October, 11 startups raised undisclosed rounds, we assigned a conservative amount of $100,000 to each. These include Akhdar, App4legal, ClingGold, Clozer, Democrance, Lockon, Orisidi, OBM, Sharethelove, ZogiLabs, and Paylink.

Other developments

Last month saw a couple of acquisitions including UAE’s Shipsy’s acquisition of India’s Stockbone and Saudi CashIN of Cardless.

Saudi venture capital firm SVC invested $10 million in Ruya Private Capital I to support local small businesses in the country and also participated in IMPACT46’s third fund.

Meanwhile, Anava invested $5 million in Titan Seed Fund I to empower homegrown Tunisian startups.

Also in October, 500 Global and ITIDA launched the Scale Up Programme for Egyptian startups.

These monthly reports are a collaboration between Wamda and Digital Digest.