Mena startups raised $760 million in February 2023

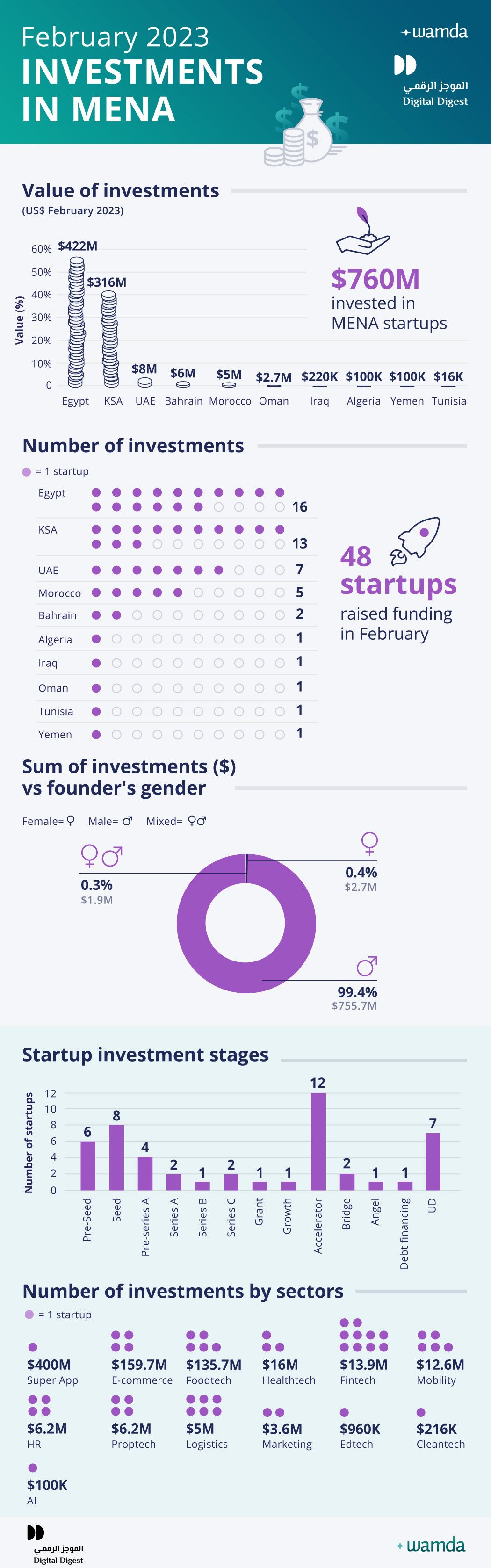

Startups in the Middle East and North Africa region (Mena) raised $760 million across 48 deals, up from 22 deals worth $104 million in January this year. The funding value soared by 638 per cent month-on-month and 103 per cent year-on-year.

Becoming the most-funded super app in the region, Egypt’s MNT-Halan attained unicorn status last month after scooping up a $400 million round at a post-funding valuation of over $1 billion, placing Egypt in first position in terms of the funding amount. Barring MNT-Halan’s round, Egyptian startups received $22 million across15 deals.

Saudi Arabia came in second with $316 million spread over 13 deals. The amount was largely led by e-gifting marketplace Floward and foodtech startup Nana, raising $156 million and $133 million respectively. The UAE was a distant third, attracting just $8 million raised across seven deals.

Smaller ecosystems such as Bahrain, Morocco, and Oman also emerged as strong hubs for venture capital after attracting substantial amounts of funding in February.

In terms of value, late-stage startups comprised 93 per cent of the funding activity. Meanwhile, early-stage startups secured most of the deals, driven by the graduation of 12 startups from Flat6Labs’ Cairo Seed programme. Notably, a major slowdown in funding was pronounced at the Seed and pre-Seed stages.

The top three sectors that received the most funding were super app, e-commerce and foodtech, collectively accounting for more than 90 per cent of funding activity. Healthtech, fintech and mobility were next on the list.

In terms of deal count, fintech came out on top as startups in the sector received 10 deals worth over $13 million. This was followed closely by logistics, mobility and HR.

Last month saw a sharp decline in international funding allocated to startups in Mena. Of 48 deals, only nine attracted foreign investment while regional investors participated in 41 deals.

Gender-wise, male-founded startups received 99 per cent of the funding raised in February across 45 deals, while only one round was raised by a female founder. Startups co-founded by men and women accounted for two deals worth $2 million.

Key highlights

Last month saw multiple fund launches including a $133 million fund by Impact46, and a $20 million Saudi Seed fund by Flat6labs.

Other announcements include the launch of Hub71+ Digital Assets, a $2 billion ecosystem dedicated to nurture the growth of Web3 startups and a $150 million investment platform launched by STV as well as CoreAngelMEA, the regional spinoff of global angel networking group, CoreAngels.

On the acquisition front, four deals were recorded in February. The list counts Noon's acquisition of Namshi, Indian Make O's acquisition of UAE's Smileneo, Hala's acquisition of Paymennt, and e&'s acquisition of UAE-based ServiceMarket.

Last month, six startups did not disclose the exact amount they raised. They include Tawseel, Rayz, SANTECHTURE, Talabtcom, Wedelive, and Holo. We assigned a conservative amount of $100,000 to the first four and $1,000,000 to the last two.

These monthly funding reports are a collaboration between Wamda and Digital Digest