Mena startups raised $103 million in January 2023

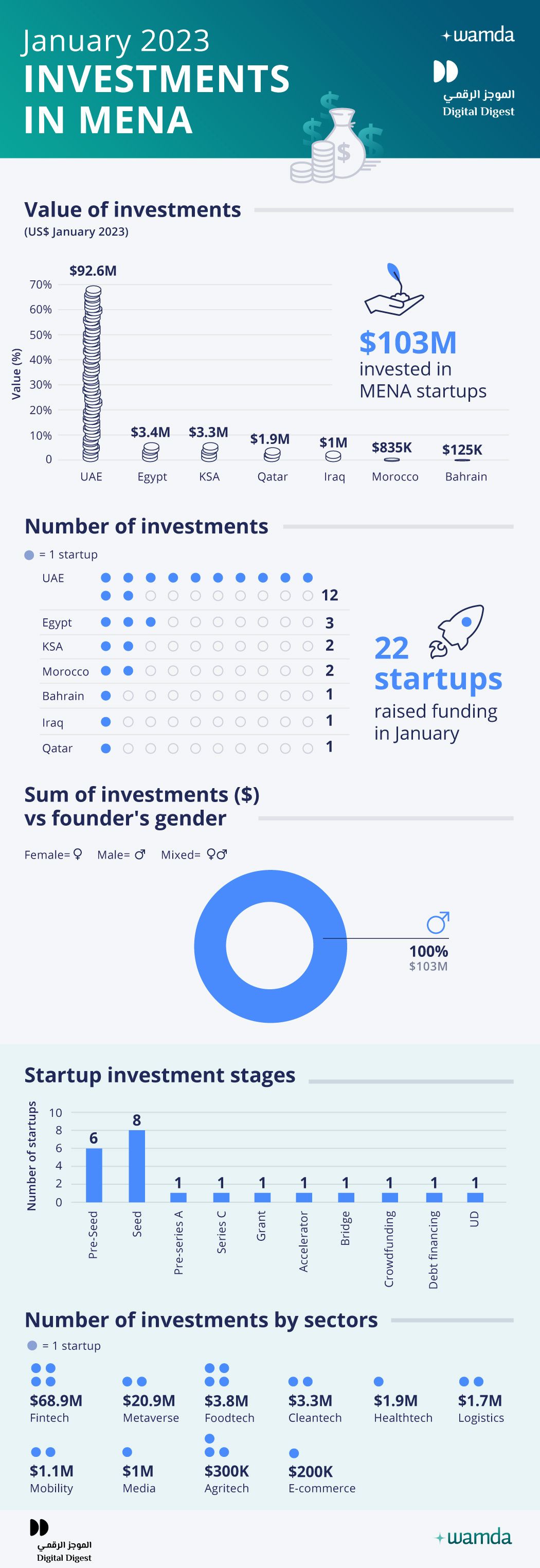

Startups in the Middle East and North Africa (Mena) raised $103 million in January 2023 across 22 deals, a 17 per cent decline month-on-month in terms of funding value, marking a cautious start to the year.

Year-on-year, the funding value slipped 66 per cent from the $299 million while the deal count also showed a sharp decline, plummeting 73 per cent from 81 deals recorded in January 2022.

Country-wise, it was the UAE that brought in the most deals, with startups raising $92.6 million across 12 deals, translating to 90.6 per cent of the total funds raised. Egypt was a distant second with $3.45 million across three deals thanks to a $3 million debt financing round raised by cleantech KarmSolar.

Saudi Arabia came in third with $3.3 million raised across only a couple of investments, with cloud kitchen operator Matbakhi being its larger fundraiser, attracting a $2.3 million pre-Seed round. The remaining 3 per cent of the funds went to startups in Iraq, Morocco, and Qatar.

The largest chunk of the funding value was largely driven by UAE's buy now pay later (BNPL) startup tabby, whose $58 million round accounted for 57 per cent of the deal value. The next largest round went to metaverse startup Numi, which raised $20 million from the recently-launched Venom Ventures.

Notably, last month saw a higher inflow of capital going to early-stage startups, which represented 36 per cent of the total funding value. As is nearly always the case, early-stage rounds continue to dominate in terms of the deal count.

Several trends seen in previous months carried forward to this year. Fintech retained its top position as the sector with the most investment, scooping up 67 per cent of the deal value. However, in terms of deal count, fintech was neck to neck with foodtech.

Other sectors that attracted substantial funding include metaverse thanks to Numi’s round, cleantech, fueled by Karm Solar's raise and foodtech, buoyed up by the sustained investor interest in food ordering platforms.

Of the 22 deals, 10 saw direct foreign investment while 12 attracted regional investors with Saudi Arabia-based investors being the most active.

For the first time, the entirety of the investment in January went to male-founded startups. Not a single female founded or co-founded startup raised investment last month.

Acquisitions

Continuing its momentum, last month saw a flurry of acquisitions and mergers (M&A) activity.

Notable examples include Egypt’s GBarena acquisition of Tunisia’s Galactech in a $15 million share swap deal, UAE-based Hotdesk’s acquisition of Spain-based YADO, Bahrain-based Beyon Cyber's acquisition of DTS Solution, and UAE-based Astra Tech’s acquisition of Botim.

Last month, Terra and AlSaree3 did not disclose the exact amount they raised, we gave a conservative amount of $100,000 to the first and $1,000,000 to the latter.

These monthly reports are a collaboration between Wamda and Digital Digest.