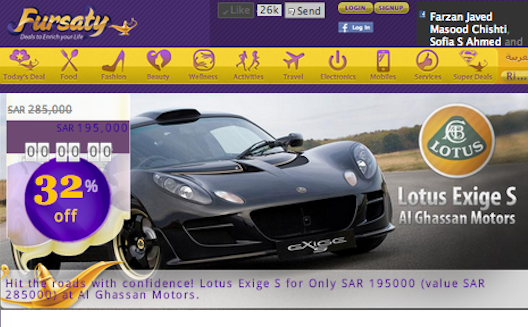

Need a Coupon for a Sportscar? Fursaty Offers Daily Deals, Saudi Style

Daily deals in Saudi Arabia aren’t like daily

deals elsewhere. Where else would you buy a Bentley online at 32%

off?

Daily deals in Saudi Arabia aren’t like daily

deals elsewhere. Where else would you buy a Bentley online at 32%

off?

“Months later after that deal, people were

still calling us asking if we had any other Bentleys at a

discount,” says Alper Celen, founder of Fursaty, the biggest daily deals site

based in Saudi Arabia.

“Who are we to market Bentley?” muses Celen, a Turkish-American who

now lives between Riyadh and Dubai. Yet if the global success of

daily deals have proven anything over the past couple of years,

it’s that everyone loves a discount, even Saudi shoppers, who spent

over

$520 million online in 2010.

To serve the Saudi market, Fursaty, which launched in April 2012,

offers bigger ticket items in its “Super Deals”

section. Its beckoning sportscars and ornate design flourishes

are expressly tailored for local buyers, says Celen. “Our colors,

our brand, and our team are local.” The team is pointedly local as

well; aside from his Turkish General Manager Uluç Yuca, everyone

else on the team is either native Saudi or born in the country.

What’s more, 50% of the Fursaty team members are women, who work

from Fursaty’s gender-divided office in Riyadh, and from home in

Jeddah and Dammam. Most are fresh out of college and have taken to

Fursaty’s fast-paced sales culture, says Celen.

“I find women to be harder working,” says Celen. They manage to

close deals that men simply cannot. “If you're doing deals for

women, men cannot go into a manicure parlor.”

Focusing on Partnerships

In the Middle East, as in many emerging markets, the daily deals

model has suffered some backlash after its initial boom. One of the

last markets to witness a slew of daily deal closures, the Middle

East saw early success story GoNabit close last year, less than a

year after its acquisition by LivingSocial.

While rival Cobone is still the biggest daily deals site in the

region, Fursaty, which was built by consulting and investment firm

CommitNetwork, is

working to gain on its competitor by launching a series of

partnerships with telecom companies and banks to distribute its

deals.

Last year, Fursaty signed with Saudi Arab British Bank (SABB) to

offer exclusive discounts for SABB credit card holders on

Saturdays. As the deal site doesn’t currently offer cash on

delivery as a payment option, the partnership helps to further

incentivize credit card use.

Fursaty has also just inked a deal with Saudi Telecom Company

(STC) to power the telecom company’s first daily deals site,

stc-deals.com. Rather than

spend extensively on advertising to power customer acquisition,

Fursaty intends to scale its partnership model throughout Saudi

Arabia and the GCC, excluding the UAE, says Celen.

Payment challenges

With another deal with Saudi Post in the works, to build out

an e-mall,

Fursaty is betting that a partnership model will enable it to

thrive in a market known for its love of cash on delivery.

While cash on delivery (COD) can lead to unpaid, uncollected

coupons, reducing a site’s effectiveness and overall margin, as it

it’s often essential for online retailers in the Saudi market, as

it’s requested in up to 70% of orders.

“Payments remain our biggest challenge,” says Celen. “We still get

comments from end users attempting to pay in cash at our office in

Riyadh.”

While Fursaty currently offers payment via PayPal

and CashU, its team is also working on a new solution for direct

integration with online bank accounts, hoping to exhaust other

options before turning on COD.

For parent company CommitNetwork, the model is one that it hopes to

scale as it localizes other e-commerce models such as online food

ordering, which Yemeksepeti pioneered in Turkey. It might be hard

(or foolish) for a Turkish entrepreneur to look at that company’s

recent

$44 million in funding from Atlantic General and not reach to

replicate its model in the Arab world’s biggest market;

CommitNetwork will soon launch Aklaty to do exactly that.

As the Middle East e-commerce sector continues to grow, B2B models

and partnerships with telecoms are proving good models for

monetizing in a market where depending on consumers alone can make

for a slower road to profitability.

And as telecoms become increasingly interested in differentiating

themselves, it’s now a regional race to see who can nab

partnerships first and test demand.