Mena: A fertile ground for tech IPOs

Sandeep Ganediwalla is a partner at Redseer Strategy Consultants looking at the Middle East and Africa

The Middle East and North Africa (Mena) region is characterised by a vibrant and digitally evolved population. It has an internet penetration of over 60 per cent, backed by a supportive macro infrastructure and strong enablers, which have spurred the growth of scalable startups in the digital sector. The last two years have been important for public markets in Mena, with many companies opting for the initial public offering (IPO) route, including a few marquee brands. Given the global macro environment, 2023 might be slightly slower. However, with a maturing startup ecosystem supported by favourable policies and investor confidence, the coming years are set to witness more unicorns and “soonicorns” rise in the region, with many ripe for IPO by the end of the decade.

Mena’s digital economy is expected to cross the $500 billion milestone by 2030

The growth journey of Mena’s digital economy can be divided into three phases. The first was the ‘growing phase’ from 2016 to 2019. Tech-savvy, Gen Y, and affluent consumers were the earliest adopters of the digital economy. Strong internet penetration and educated customers also drove the digital trends prompting e-commerce or “e-tailing” players to move into the digital space.

2019 to 2022 was the ‘disruption phase’ as the Covid-19 pandemic necessitated mass adoption of e-commerce, with a majority of new customers being tech savvy. Skyrocketing need for doorstep delivery of essentials led to a period of steep growth for players in the online grocery, food delivery, and other quick commerce space.

The period 2022 to 2027 will be the ‘acceleration phase’ of Mena’s digital economy. The post-pandemic years catalysed growth diversification, and emerging sectors such as healthtech, edtech, and fintech will scale to meet consumer demand. Furthermore, ongoing governmental support in the region through regulation initiatives will continue to propel growth, with much development set to arrive from hinterlands. Growing at a +22 per cent CAGR, the digital economy is expected to cross $500 billion by 2030.

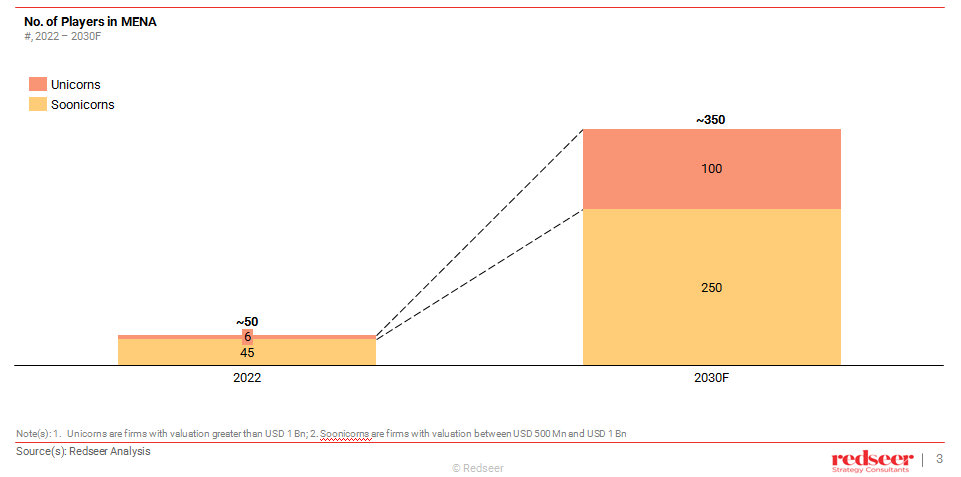

Continued growth will result in ~350 unicorns and soonicorns

Millions of people in Mena now have access to digital services with smartphones and tablets, enabling them to fully utilise the benefits of the digital economy. While the pandemic substantially pushed digital adoption worldwide, Mena received a stronger boost. As consumers embrace digital avenues across industries, the region’s tech companies are riding the digital wave to unlock new opportunities.

The growing consumer market will not only spawn new startups but propel existing players across all segments to profitability, prepping the stage for the emergence of many unicorns and soonicorns. Of all the digital sectors, e-commerce and fintech are expected to lead with a 50 per cent share in the total number of startups reaching ‘unicorn’ status. With e-tailing becoming the prime mover of retail growth in the region, fintech takes its place as an enabler of the digital economy. Together with other digital players, the 300+ startups can create a strong pipeline for IPOs in the region by 2030.

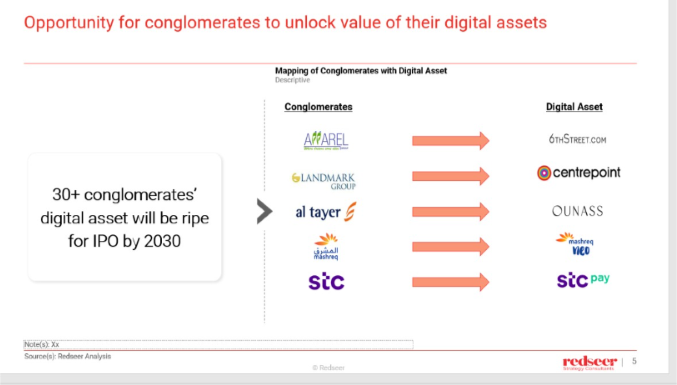

30+ Conglomerates have assets that will be ripe for IPO by 2030

There are a lot of digital startups that are incubated by Mena’s conglomerates. We expect many of these startups will be ripe for IPOs in the coming years. These prominent omnichannel players with online and offline presence have a lucrative opportunity to unlock value through their digital assets. While most of these conglomerates are profitable, the high-growth investments in creating digital assets will only position them to unlock incredible value and drive growth.

Regulatory reforms have given a boost to the public markets in Mena

While the regulations vary by country, initiatives and developments are at play in all Mena markets to establish themselves as important factors in global equity markets and enhance the investor experience.

For instance, the governments in the economies of GCC, the UAE, and Saudi Arabia are focused on increasing the depth of their local public markets by listing public entities (SALIK, DEWA) and are creating enabling frameworks for listings of the private sector.

Some of the noteworthy reforms in the Mena region include:

-

In 2020, The UAE Securities and Commodities Authority (SCA) issued regulations permitting companies in the UAE’s free zones to carry out public offerings.

-

Saudi Arabia reduced the threshold of the Assets Under Management (AUM) of potential investors looking to enter the Saudi market from $1 billion to $500 million.

-

Saudi Arabia’s Tadawul also amended the fluctuation limit mechanism for newly listed stocks to 30 per cent from 10 per cent for the first three days of trading.

A deliberate and goal-based approach is necessary to be IPO-ready

Being IPO-ready takes a long-term, goal-based, and real-time approach with a focus on the right aspects. At the heart of the process is the definition of goals, tracking metrics in real-time, solving to plug gaps and improvement, and recording DRHP or offer document through the process. Maintaining focus on aspects such as market leadership, clearly visible total addressable market, sizable valuation, MOATS/multiple use cases, diversification, consumer love, predictable revenues, high operating leverage, achieved sustainable unit economics, and clear path to profitability is also essential.

Finally, it is crucial to establish ecosystem relationships early by building rapport with the investors and keeping an open line of communication that emphasises transparency and corporate governance. Strengthening chief financial officer engagement and investor relations also goes a long way in leading the IPO process.

Mena has lots of untapped potential in the tech space; this alone would be key to some 100 upcoming IPOs expected to take place in the current decade. The region has a distinct digital economy landscape wherein the region’s biggest conglomerates such as Apparel Group, Landmark Group, Al Tayer Group of Companies, Mashreq, and the Saudi Telecom Company (STC) have created innovative digital assets that would be ripe for IPOs by 2030. Overall, while the IPO market in the Mena region is still relatively small compared to other global markets, it has been growing in recent times and is likely to continue attracting attention from companies and investors for years to come.