Mena startups raised $378 million in August 2022

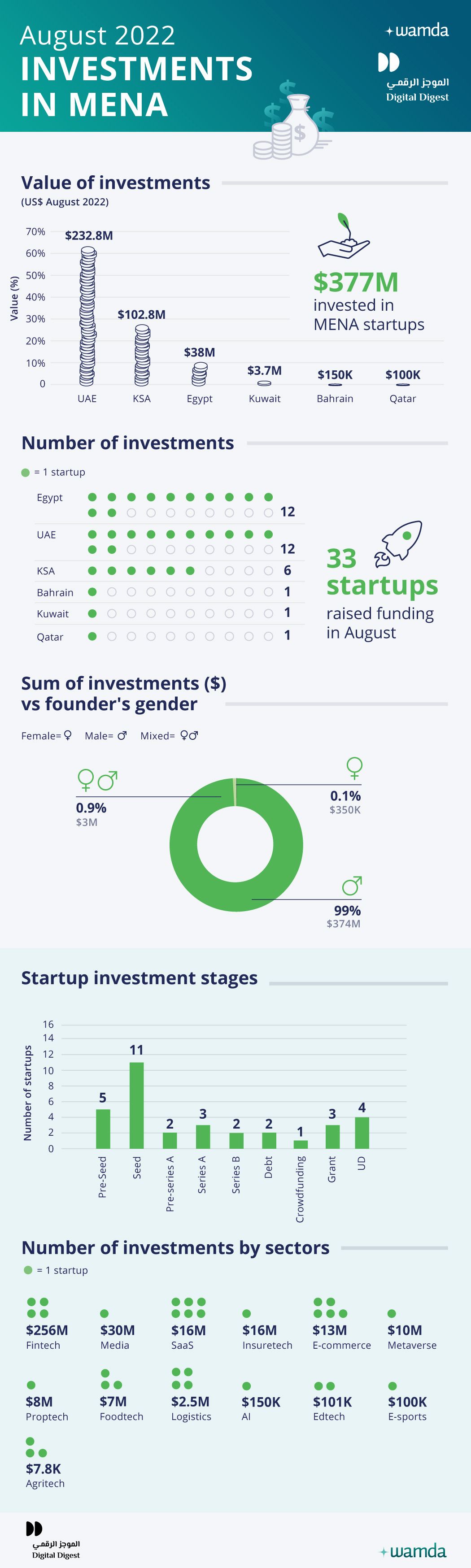

Startups in the Middle East and North Africa region (Mena) raised $378 million across 33 deals, a 260 per cent increase in funding value month-on-month but a relative dip in terms of deal count.

This takes the total amassed in the past eight months to $2.2 billion, a 29 per cent increase from the $1.7 billion recorded during the same period last year.

Last month saw two of the biggest funding rounds recorded this year in the region's tech ecosystem, with fintechs Tabby and Tamara raising a $150 million loan and $100 million respectively, making up 66 per cent of the VC funding value.

Setting aside the two outliers, just $128 million was invested in startups across Mena in August.

Thanks to Tabby's large loan, the UAE attained the number one spot on the list of the countries that attracted the maximum funding with $233 million.

Saudi Arabia was the second largest recipient of funding with $103 million raised across six deals, with Tamara being its biggest fundraiser, while Egypt followed in the third position with $38 million. Both UAE and Egypt were neck to neck in terms of deal count.

The modest recovery seen in August has been widely felt across all funding stages with the earliest stages of funding witnessing the highest deal count. Out of 33 deals, 15 went to startups across the pre-Seed and Seed stages, cumulatively amounting to $14.5 million.

The lingering uncertainty in market conditions have largely dented the ability of growth stage companies to raise new rounds of equity, and so we are likely to see more extention or bridge rounds over the coming few months. This was evident in the case of Egypt's furniture e-commerce company Homzmart and UAE-based adtech ArabyAds and digital real estate investment platform Stake. These startups also happen to be among the top fundraisers last month.

Startups operating in the fintech space piqued investor interest in August particularly startups in buy now pay later, crypto currency and neobanking. In terms of value, fintech remains the best-funded sector, representing 68 per cent of the total funding activity. E-commerce came in second place with $32 million raised across five deals, followed closely by adtech. Yet, SaaS startups attracted the highest number of deals with six investments aggregating to $16 million.

Global funding activity remains subdued, with only 13 deals out of 33 attracting foreign direct investments.

Regionally, Saudi Arabia-based investors were the most active, taking part in 10 deals, followed by their counterparts from the UAE with eight deals.

As ever, startups with an all-male founding team attracted the bulk of funding last month with 99 per cent, while the remaining 1 per cent went to startups founded or co-founded by women.

Key market highlights

Apart from the funding, last month saw a rise in the mergers and acquisitions (M&A) activity.

UAE-based proptech Huspy, which recently closed a $37 million Series A round, announced its takeover of two mortgage brokers: Just Mortgages and Finance Labs, while logistics startup Cartlow purchased Melltoo. This came on the back of its recent completion of a $18 million round.

Other deals include Maya Group's acquisition of Conktr, Astratech of fintech PayBy and KABI of HR tech startup BLOOVO.

In August, a couple of startup-focused funds were launched. Algeria Startup Fund announced its new fund worth $411 million earmarked for local startups, while G42 also launched a $10 billion fund to invest in growth stage startups.

Last month, Mosool, Jwava, Cargoz, Mintroute, OBM Education and Sponix Tecb did not disclose the exact amount they raised. We have assigned them a conservative amount of $100,000 each.

These monthly reports are a collaboration between Wamda and Digital Digest.