New Wamda Research Lab report sheds light on MENA investment landscape and future opportunities

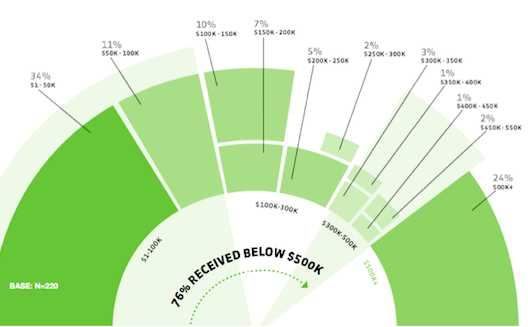

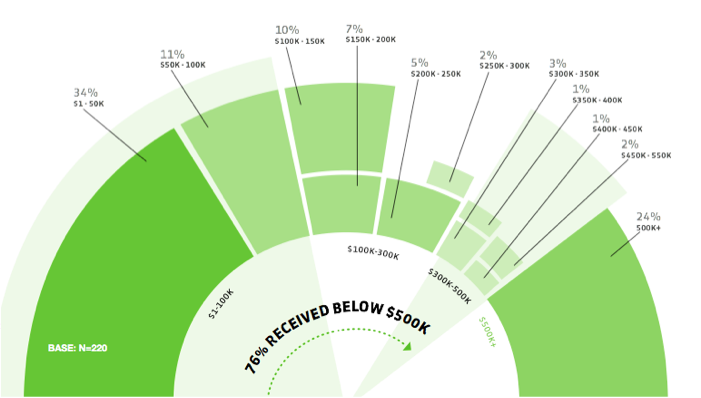

76% of surveyed MENA startups surveyed have received funding below $500,000 (full report here)

Entrepreneurs that have the ambition to grow their company often reference limited funding as a barrier to achieving their goals. Whether just starting out, launching a new product or expanding into a new country, access to capital is a critical resource that is not always easy to obtain. The investment ecosystem for startups in the Middle East and North Africa (MENA) is no exception, yet in recent years funding access in the region has improved.

Angel investment networks, venture capital funds, and even several government-initiated funding programs have all come to the fore. As the region’s entrepreneurship ecosystem gradually frees up more capital for young and growing enterprises, it has become increasingly important to look critically at MENA entrepreneurs’ and investors’ specific needs in an effort to consistently enhance investment conditions.

The Wamda Research Lab’s newest study, Enhancing Access: Assessing the Funding Landscape for MENA’s Startups, provides a comprehensive overview of funding conditions for entrepreneurial ventures in the region. The report diagnoses gaps, and offers an understanding of the critical steps in the funding process for both entrepreneurs and investors, to begin informing the ecosystem on how best to address funding challenges for startups in the region.

The following statistics represent the study’s main findings:

(1) Funding activity has grown and continues to rise:

More investments in MENA: The #WamdaResearch Lab found the number of investments in MENA startups increased from 28 in 2009 to 99 in 2012. Tweet this stat.

Number of investments by year

More sources for capital: WRL identified 50 funding sources for MENA entrepreneurs in 2013, compared to fewer than 20 in 2008. #WamdaResearch. Tweet this stat.

Funding sources for entrepreneurs (2008 – 2013)

Funders plan to expand: 83% of funders surveyed by WRL plan to expand and increase their activity in MENA in 1-2 years. #WamdaResearch. Tweet this stat.

(2) Companies that received funding are also growing:

Signs of scaleups: 60% of companies surveyed by #WamdaResearch Lab with 3-year compound annual growth rates (CAGRs) are scale-ups. Tweet this stat.

In #WamdaResearch Lab’s most recent study, scaleups are companies over 3 years old with job growth at, or above, 20%. Tweet this stat.

Employment growth: In WRL’s sample of funded MENA companies, 74% with 3-year CAGRs are growing. #WamdaResearch. Tweet this stat.

Expanding across borders: 76% of companies in the #WamdaResearch study plan to open new offices in the next 1-2 years, especially in KSA & UAE. Tweet this stat.

(3) Companies need more big-ticket investments and more commitment to follow-up capital:

Large investment sizes are scarce: #WamdaResearch Lab surveyed MENA companies & found a gap in funding for $500,000+ USD. Tweet this stat.

Loans are hard to come by: Only 12% of companies studied by #WamdaResearch Lab had received a working capital loan. Tweet this stat.

(4) Skills and communication gaps limit entrepreneurs’ efforts to get funding:

Entrepreneurs’ Skills Gaps 1: 65% of MENA funders in #WamdaResearch Lab survey report entrepreneurs lacking strategic planning & decision-making. Tweet this stat.

What skills are entrepreneurs lacking? (According to funders)

Entrepreneurs’ Skills Gaps 2: 44% of MENA funders in #WamdaResearch Lab survey cite financial literacy as a skill gap in entrepreneurs. Tweet this stat.

Entrepreneurs’ Skills Gaps 3: 29% of MENA funders in #WamdaResearch Lab survey felt entrepreneurs do not effectively pitch their ideas. Tweet this stat.

Challenges to obtaining investment (funders vs. entrepreneurs)

What about funders?: 28% of MENA entrepreneurs in #WamdaResearch Lab survey felt investors do not give enough beyond cash. Tweet this stat.

(5) Entrepreneurs and investors need to facilitate knowledge sharing to achieve their goals:

Communication is key: #WamdaResearch Lab says communication between investors and entrepreneurs can spark mentor relationships as well as new deals. Tweet this stat.

Read the entire report to see more, including Wamda Research Lab’s recommendations and benchmarks to enhance funding conditions for MENA’s entrepreneurs and investors.