Mena startups raised $247 million in January 2022

Startups in the Middle East and North Africa region (Mena) raised $247 million across 46 deals, a 20 per cent increase month-on-month and a whopping 474 per cent year-on-year, marking a promising start to the year.

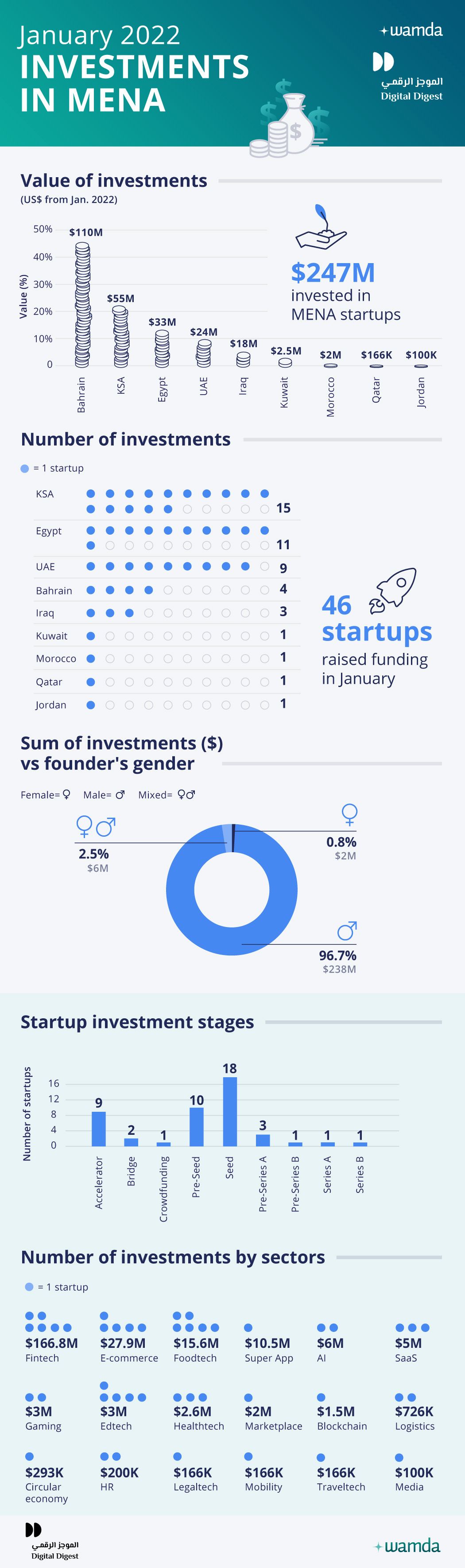

In terms of deal count, Saudi Arabia (15), Egypt (11) and UAE (9) continue to take the lead. However, in terms of funding value, the landscape last month has become a little more varied.

It was Bahrain that received the highest amount of funding last month thanks to the $110 million Series B round raised by Rain, which helped push the country's ranking to the top spot.

Saudi Arabia came in second with $55.6 million, Egypt landed third with $33 million, UAE was fourth with $24.4 million. Iraq took the fifth spot with its startups raising $15 million, a record-smashing amount for the country.

Besides Rain, other big-ticket rounds included Saudi open banking platform Lean Technologies, which raised $33 million in a round led by Seqouia Capital India, Egypt's social commerce startup Brimore raised $25 million, UAE-based in-dining fast payment solution Qlub raised $17 million. Iraq’s ride-hailing startup and soon-to-be super app Baly, backed by Rocket Internet, raised $10.5 million, the highest funding amount for a startup in the country.

Early-stage deals continue to dominate the funding landscape in terms of deal count. Of the 46 deals, 28 were at pre-Seed and Seed. Notably, the median Seed ticket size also increased to $1.15 million.

In terms of sector, investment patterns that evolved last year have continued into January with fintech taking the lead thanks mainly to Rain, Lean and Qlub’s large rounds - fintech alone attracted more than half of the funding raised last month. This was followed by e-commerce and foodtech, the latter benefitting from the rise of quick-commerce e-grocery players. In terms of deal count, fintech and foodtech were neck to neck.

Additionally, last month saw a spate of merger and acquisition (M&A) transactions, with startups using the funding they received last year to acquire other businesses including those based in the region and wider afield.

Some of these acquisitions include Saudi Arabia’s Foodics which acquired Jordan-based POSRocket, UAE's Huspy which acquired Home Matters, a mortgage consultancy for businesses in UAE and UK and Kuwait’s COFE App which acquired UAE-based Sippy Beans.

A total of 31 foreign investors participated in 17 deals with US investors taking the lead by participating in 12 deals, while German investors, the second-most active, took part in three deals.

Less than 1 per cent of the VC funding went to female founders, down from 1.6 per cent the month before. Male-run startups took the majority, with 96.7 per cent of the amount raised while startups with mixed team founders raised 2.5 per cent.

Last month, 10 startups did not disclose the exact amount they raised. They include Splendapp, Crafty Workshop, OBM Education, Super fny, Talpedia, Hamples, Douk Supply, Savii and Squadio. We assigned them a conservative amount of $100,000. Morocco's Chari also raised an undisclosed “seven-figure” sum.

These monthly reports are a collaboration between Wamda and Digital Digest.