Clean disruption: The rise of clean beauty marketplaces in Mena

It was personal need that pushed Amina Grimen and Ayat Toufeeq to launch an e-commerce site dedicated to skincare. The pair were struggling to solve their own skincare problems and had no access in Dubai to the clean beauty products that were becoming popular around the world. And so they launched Powder.ae in 2018, becoming the first company to provide the GCC region with “clean” skincare and makeup products.

Since then, several brands have emerged in the Middle East focusing on clean beauty, as consumers in the region become more aware of the ingredients that go into these products.

There is no regulated definition for what can be classified as “clean”, but generally they are products void of toxins, sometimes created and packaged with sustainability and environmental ethics in mind.

“We define it as nontoxic. Skincare and beauty products that are free of ingredients that are essentially not good for you,” says Grimen. “Consumers are concerned about what they are putting on their bodies and skin and this making them comfortable in their own skin – it is no longer about concealing but rather enhancing your natural beauty.”

The global cosmetics industry is projected to reach $463.5 billion by 2027 according to Allied Market Research and within that, skincare and clean beauty is among the fastest growing segments. In the Middle East and North Africa (Mena) region, the cosmetics skincare market was valued at $4.67 billion in 2020 and is expected to grow to $5.05 billion by the end of this year, before surpassing $6 billion in 2024 according to Statista.

Traditionally, most cosmetics products were purchased offline from legacy brands like L’Oreal, Mac and Lancôme. But the rise of social media gave birth to new, online-led brands, some a result of collaborations with celebrities and influencers and these legacy brands, others entirely new cosmetics companies founded and led by celebrities. These include wildly successful brands like makeup artist Huda Kattan’s Huda Beauty, singer Rihanna’s Fenty Beauty and reality TV star Kylie Jenner’s Kylie Cosmetics, all of which adopted an online first, direct-to-consumer approach.

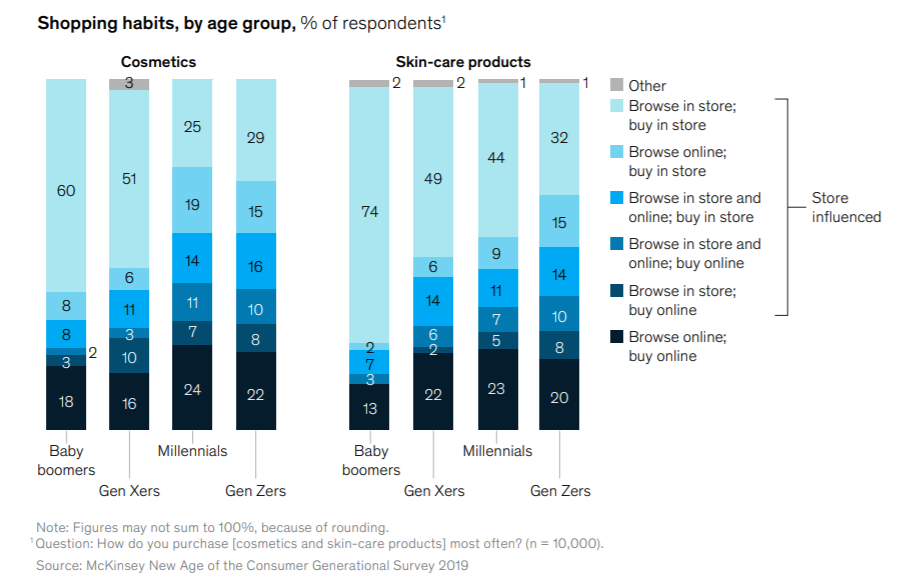

Prior to the pandemic, 40 per cent of Gen Z and 42 per cent of millennials purchased cosmetics online, now, after the pandemic, online sales of cosmetics have increased and the industry is being disrupted once again – this time, with the rise in demand for clean products and skincare. Makeup brands have shifted their focus onto skincare, even Huda Beauty, Fenty and Kylie Cosmetics have launched their own skincare lines. For Powder, competition has intensified as several clean beauty e-commerce sites have emerged including Glow Getters, Hoiisa, Balmessence, Beautiful Brands, Aspire Beauty Co, Secret Skin and Miss Pallettable, all of which are based in the UAE, the country with the highest spend per capita on cosmetics in the region.

“We are seeing that many legacy brands are hopping on board the 'clean beauty' movement, but niche or indie brands are winning the race with consumers. We believe this is because consumers are more confident with brands that have sustainability at their core which have a culture of transparency which consumers are after. They also offer more choice to the educated and digitally savvy consumers in the region and globally,” says Grimen.

While the trend for clean beauty began several years ago in the US, it is ultimately due to the pandemic that growth has rocketed. As work from home became the norm and the mandatory need to wear face masks was implemented around the world, makeup sales declined, especially offline. Coupled with the messaging around self-care and wellbeing during this time and taking care of one’s immunity, focus shifted to ‘goodness from within’.

“Just as people are eating healthier, exercising more, and taking care of their bodies, they are now looking after their skin. Skincare has really become a frontrunner in the beauty space following Covid,” says Grimen. “It was already on the rise in the past couple of years, but the pandemic with the rise of self-care has fast-tracked the industry. As a result, wellness and selfcare is becoming a lifestyle affecting all facets of life rather than being an occasional observance.”

The focus on wellbeing has permeated other sectors too, including food and fitness.

“They overlap and intertwine,” says Sarah Al Shaalan, research analyst for lifestyle and behaviour at Mintel. “It extends beyond clean eating to clean living and there is much more awareness when it comes to that. Middle East consumers are tech savvy when it comes to bloggers and Instagram and audiences engage well with marketing strategies that have clean products, those with no chemicals or additives and include ingredients that are not harmful on the skin.”

But, there is still a need for more education and understanding of what we are putting in and on our bodies. Secret Skin founder Anisha Oberoi is looking to target young girls to raise awareness of ingredients used in the beauty industry.

“I want to go to schools and talk to young girls before they start using beauty products, we want to enable the women in this region to own and manage their own health,” says Oberoi. “In this region the impetus on recycling is building, sales of organic groceries have gone up, every beauty brand is trying to clean up their act. The customer is a lot more intelligent, they’re turning the box and looking at the preservatives that are in the product.”

While the clean beauty sector is growing in the region, the likes of Powder, Secret Skin and others are facing challenges that other e-commerce startups currently face coupled with a male-dominated investment market that is only just realising the investment opportunity in this space.

“For a small but growing startup such as ours, raising awareness in an expensive digital market that is crowded has been challenging,” says Grimen. “Additionally, as we continue to grow, finding and attracting the right talent on a budget has also been difficult when it comes to matching salary expectations. The talent is here but finding someone with skills who is ready to play the long game takes time.”