MENA startup funding hits $3.5 billion in September 2025, lifting Q3 total to $4.5 billion

Record-breaking month caps a standout Q3 as Saudi Arabia dominates regional investment landscape

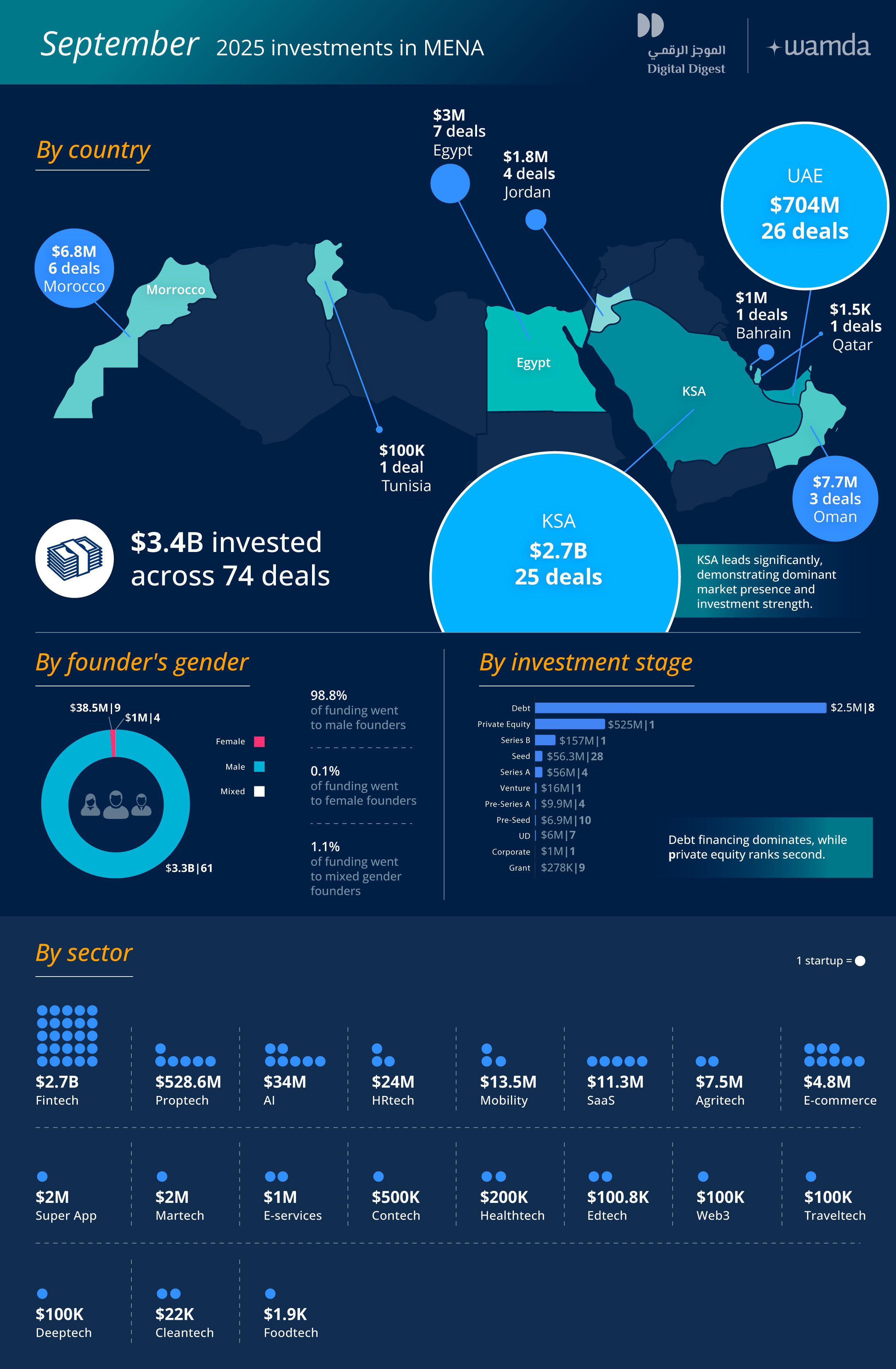

Startup investment in the Middle East and North Africa (MENA) hit a record high in September 2025, soaring to $3.5 billion across 74 deals, according to Wamda data. That’s a 914% month-on-month and 1105% year-on-year leap, a staggering rebound from August’s $337.5 million.

Even after excluding the $2.6 billion in debt financing, the month still marks one of the region’s strongest performances, with 147% MoM and 194% YoY growth in equity funding alone.

Saudi Arabia steals the show

The surge was largely fuelled by a wave of mega-deals from Saudi fintechs, led by Tamara’s $2.4 billion debt facility, Hala’s $157 million Series B, Lendo’s $50 million debt, and Erad’s $33 million debt financing.

Saudi Arabia once again topped the regional charts, with 25 startups raising a combined $2.7 billion. Much of this momentum stemmed from Money20/20, the fintech sector’s headline event, where 15 deals were announced.

UAE maintains strong second place

The UAE ranked second, with 26 startups collectively raising $704.3 million, reflecting sustained investor appetite in Dubai and Abu Dhabi’s more mature startup ecosystem. Oman followed in distant third, where three startups secured $7.7 million, while six Moroccan startups raised $6.8 million.

Meanwhile, Egyptian startups continued to struggle, attracting just $3.2 million across seven deals, as macroeconomic challenges and currency volatility continue to weigh on investor sentiment.

Fintech leads, proptech follows

Fintech dominated sectoral activity, accounting for $2.8 billion across 25 deals, driven by Saudi megadeals. Proptech followed with $528.6 million, almost entirely powered by Property Finder’s $525 million round.

Beyond these, AI startups secured $34.3 million across seven transactions, while HRtech companies collectively raised $24.2 million.

Early-stage startups dominate deal count

Despite the headline numbers being dominated by late-stage and debt deals, early-stage startups represented the majority of deal flow; 55 startups raised $129.4 million. By comparison, later-stage startups closed just four rounds but attracted $699 million in total. This skew underscores investors’ growing appetite for mature ventures capable of scaling or consolidating in key verticals.

B2B2C model takes the lead

For the first time, B2B2C startups outperformed all other models, securing $2.4 billion across 15 transactions.

Pure B2C startups followed with $557.3 million across 23 deals, while B2B-focused ventures raised $456.3 million in 36 transactions.

This reflects a broader trend across MENA, where hybrid business models are emerging as an efficient way to monetise both consumer and enterprise demand.

Gender gap persists

The gender imbalance remained stark: male-founded startups captured $3.3 billion, while female-founded ventures raised only $1.1 million across four deals.

The rest went to mixed-gender founding teams, continuing a pattern seen throughout 2025 where women-led startups have yet to cross the 5% funding threshold.

Q3: A quarter of breakout growth

MENA crosses $6.6 billion year-to-date through 514 rounds

The third quarter of 2025 capped an extraordinary period for the region’s startup ecosystem, with $4.5 billion raised across 180 deals, a 523% quarter-on-quarter jump.Year-to-date funding now stands at $6.6 billion, already surpassing most full-year totals since 2021.

Saudi Arabia and UAE dominate regional flows

Saudi Arabia retained its lead, attracting $3.2 billion through 62 deals, followed by the UAE’s $1.2 billion across 59 deals.

Egypt, despite its continued slowdown, ranked third with $22.3 million, while Iraq and Morocco followed with $16.5 million and $14.5 million, respectively.

Fintech still reigns supreme

Fintech remained the top-funded sector in Q3, with $3 billion channelled into 41 startups. Proptech followed with $684 million, boosted by mega-rounds such as Property Finder’s, while e-commerce entered the top three with $265 million spread over 14 deals.

Early stages still lead by volume

Of the 180 deals closed in Q3, 134 were early-stage, raising $538.3 million, while later-stage startups drew $981.3 million across 17 deals.

Meanwhile, 12 startups raised capital via debt instruments, reflecting a continued shift toward alternative financing models.

A transformational year for MENA

Despite regional turbulence, from political tensions to the war in Gaza, 2025 has proven that MENA’s venture capital ecosystem is maturing fast.

The region has become an increasingly attractive destination for both local and foreign investors, with sovereign funds, family offices, and global VCs all ramping up exposure to emerging tech sectors.

If this trajectory continues, 2025 could set an all-time funding record, reshaping how capital and innovation flow across the Arab world.

These monthly reports are a collaboration between Wamda and Digital Digest.